In todays fast-paced financial landscape, many aspiring traders are turning to simulators as a way to hone their skills and test their strategies without the risk of real money. These platforms promise a safe playground, enticing users with the prospect of refining their techniques while learning the intricacies of market dynamics.

However, beneath the surface of these digital training grounds lies a pressing question: Are these simulators offering an accurate reflection of trading potential, or are they merely inflating confidence with a false sense of security? The allure of success may mask the stark realities of real-world trading, where emotions, unforeseen market shifts, and the weight of financial stakes come into play. This article delves into the inherent discrepancies between simulated scenarios and trading realities, challenging the notion that practice alone guarantees proficiency and profit.

As we navigate this complex terrain, we must scrutinize whether the skills acquired in a pristine environment truly translate to the tumultuous world of actual trading.

Understanding Trading Simulators: How They Work

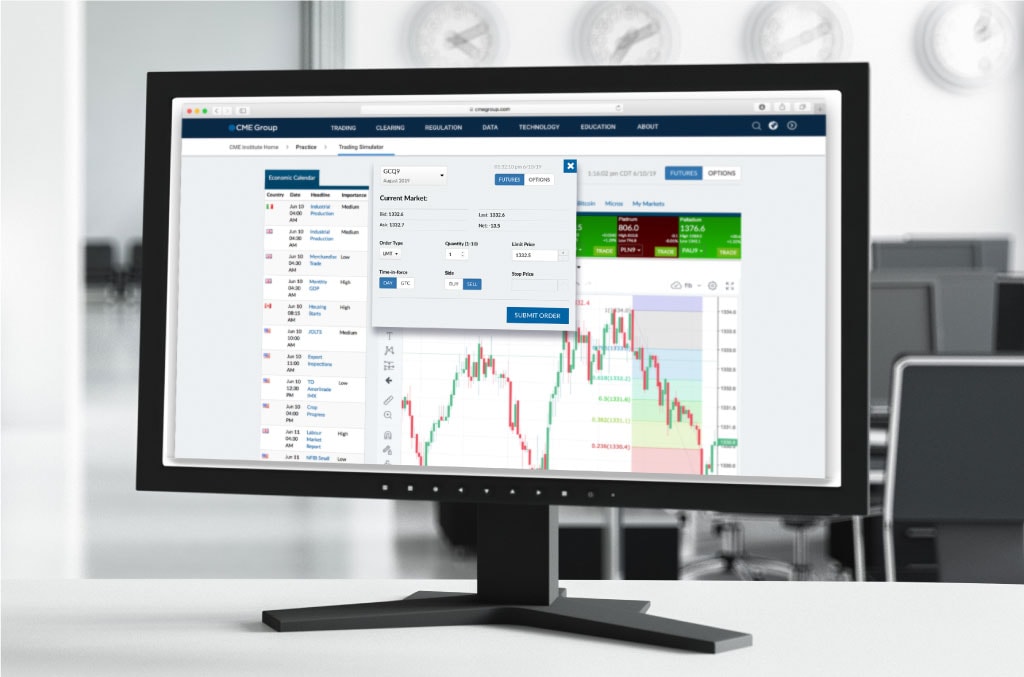

Trading simulators operate as innovative tools designed to mimic real market conditions, allowing traders to engage in simulated buying and selling without the risk of losing actual capital. At their core, these simulators blend complex algorithms with historic market data to provide users with an environment where they can test strategies, refine their skills, and develop a deeper understanding of market dynamics.

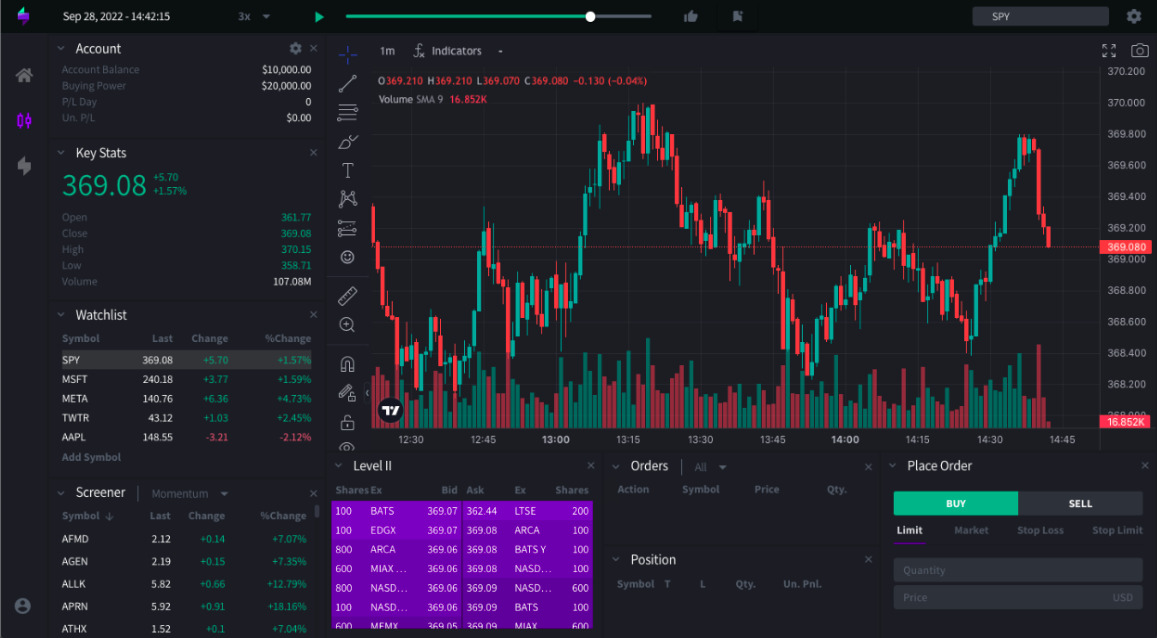

Tools like the dom chart (Depth of Market chart) enhance this experience by providing insights into market liquidity and order book details, helping users understand how their trades might interact with actual market structures. Users can choose from various assets, experiment with different trading strategies, and receive instant feedback on their performance.

However, while these simulators offer invaluable practice, they often lack the psychological pressure and real-world consequences that come with actual trading. This can lead to an inflated sense of confidence, creating the illusion of competence that may not translate to genuine trading scenarios.

Understanding these nuances is essential for anyone hoping to bridge the gap between simulation and investment reality.

The Reality of Market Conditions: Simulators vs. Real Trading

The world of trading is a chaotic dance between opportunity and risk, and while simulators offer a glimpse into this exhilarating arena, they can sometimes paint an overly rosy picture. In these virtual environments, traders may experience a thrilling rush of success, buoyed by favorable market conditions that rarely align with the unpredictable nature of reality.

Simulators allow for the practice of strategies devoid of emotional weight—theres no fear of loss or the joy of a hard-won victory as experienced in actual trading. Yet, when traders step into the live market, they confront a myriad of variables: sudden price drops, unexpected news events, and the psychological pressure of real money at stake.

The stark contrast between the controlled circumstances of a simulator and the tumultuous reality of trading can lead to disillusionment. In essence, what appears as a polished pathway to success in simulations may transform into a labyrinth of challenges when faced with real-world market conditions.

Common Pitfalls: Cognitive Bias in Simulated Trading

In the world of simulated trading, cognitive bias can be a silent yet powerful adversary, leading traders to misconceptions about their skills and decision-making. For instance, the illusion of control often rears its head, causing individuals to believe they have a greater impact on market outcomes than they truly do.

This overconfidence can result in risky behaviors—such as overtrading or ignoring sound risk management principles—because traders may mistake favorable outcomes as indicators of their expertise rather than sheer luck. Anchoring bias compounds the issue; traders may cling to initial data or assumptions, resisting new information that contradicts their established beliefs.

Moreover, the availability heuristic can skew perceptions, where recent successes in the simulator create an inflated sense of capability, overshadowing the reality that real markets present a far more complex landscape. Thus, while simulators offer valuable practice, they can inadvertently cultivate a false sense of invincibility, leaving traders vulnerable when they finally face the unpredictable nature of actual trading environments.

Conclusion

In conclusion, while trading simulators can serve as invaluable tools for learning and practice, it is crucial for traders to approach them with a healthy dose of skepticism regarding their potential for real-world application. The allure of immediate success seen in simulations may lead to overconfidence, masking the inherent risks and complexities of live trading environments.

For instance, utilizing advanced tools like the DOM chart can assist traders in refining their decision-making strategies and understanding market dynamics better; however, it is essential to recognize that these simulations often do not fully replicate the psychological pressures or unforeseen variables present in actual trading scenarios. Ultimately, achieving consistent trading success requires not only mastery of simulated conditions but also the ability to adapt, manage risk effectively, and maintain a disciplined mindset in the unpredictable world of financial markets.